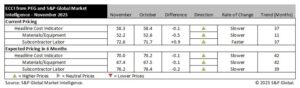

Engineering and construction costs increased again in November, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, was little changed, decreasing 0.1 points to 58.3 in November. Price pressures moderately decreased for materials and equipment costs with the sub-indicator falling to 52.2 in November from 52.6 in October. The sub-indicator for subcontractor labor costs increased to 72.6 in November, up from 71.7 in October.

The equipment and materials indicator continued to show rising prices, though there was very little change compared to October. Copper-based wire and cable saw the largest increase of any category, increasing 15.6 points to a reading of 55.6, and joining transformers, electrical equipment, gas/steam turbines, pumps and compressors, and ready-mix concrete in expansionary territory. Meanwhile, shell and tube heat exchangers as well as both ocean freight categories remained at neutral readings of 50 in November. The categories for carbon steel pipe, alloy steel pipe and fabricated structural steel all saw additional declines from October, moving them even farther into contractionary territory with readings between 21.4 and 28.6.

Thomas McCartin, principal economist at S&P, says, “It is not surprising to see the steel pipe components well below 50, indicating widespread price declines. Steel sheet and plate prices have come down considerably across 2023, undercutting input costs for pipe manufacturing. Strong supply and an inventory buildup are further weighing on pipe prices.”

The sub-indicator for current subcontractor labor costs increased for some regions and employment categories in November in the U.S., but decreased in Canada, leaving labor price increases effectively unchanged compared to October. All regions of the U.S. are still reporting tight labor markets and indicate that subcontractor labor costs continue to grow. In contrast, all regions in Canada reported a neutral market for labor costs with every subcategory registering values of 50 for November, down modestly from the October readings.

The six-month headline expectations for future construction costs indicator decreased just 0.2 points to a reading of 70 in November, illustrating that expectations for price increases are at similar levels as last month. The six-month expectations indicator for materials and equipment came in at 67.4, 0.1 points lower than October’s figure. After October, when expectations for all categories were above 50, the reading for fabricated structural steel saw a significant decline of 31.1 points bringing it down to 38.9 in November. Additionally, expectations for carbon steel pipe and shell and tube heat exchangers saw minor decreases to neutral readings of 50.

The six-month expectations indicator for subcontractor labor declined 0.2 points from October to a reading of 76.2. Increases occurred in half of the subcomponents in the U.S., especially in the Northeast and West regions, but Canada saw moderate declines leaving the overall category little changed. Subcontractor labor costs are expected to be higher in all regions of the U.S. in six months but remain unchanged in Canada.

Respondents reported some materials shortages again in November, especially for electrical equipment, transformers, breakers and wire and cable. Labor shortages for certain trades are also expected, particularly in the gas, power, and process industries. Survey respondents also indicated that higher-for-longer interest rates are impacting new projects.